The Greatest Guide To Automobile Insurance In Toccoa Ga

Table of ContentsRumored Buzz on Health Insurance In Toccoa GaThe Best Strategy To Use For Annuities In Toccoa GaHow Automobile Insurance In Toccoa Ga can Save You Time, Stress, and Money.The smart Trick of Automobile Insurance In Toccoa Ga That Nobody is Talking About

An economic expert can also help you decide exactly how ideal to accomplish objectives like saving for your child's college education or settling your debt. Although monetary advisors are not as fluent in tax obligation legislation as an accountant might be, they can offer some guidance in the tax obligation preparation process.Some economic experts supply estate preparation solutions to their clients. They could be learnt estate planning, or they may intend to deal with your estate lawyer to answer concerns concerning life insurance policy, counts on and what need to be performed with your investments after you pass away. Lastly, it is necessary for economic consultants to keep up to date with the market, financial conditions and advising best practices.

To market financial investment items, advisors need to pass the pertinent Financial Market Regulatory Authority-administered examinations such as the SIE or Collection 6 exams to acquire their certification. Advisors who want to market annuities or other insurance items must have a state insurance certificate in the state in which they prepare to offer them.

The 9-Minute Rule for Insurance In Toccoa Ga

You work with an advisor who bills you 0. Due to the fact that of the common charge framework, many consultants will certainly not function with clients who have under $1 million in properties to be handled.

Investors with smaller sized portfolios could look for a monetary expert who charges a hourly charge rather than a percent of AUM. Hourly fees for consultants generally run in between $200 and $400 an hour. The even more facility your financial situation is, the more time your consultant will have to dedicate to managing your possessions, making it a lot more pricey.

Advisors are skilled professionals who can help you establish a prepare for monetary success and execute it. You could likewise take into consideration getting to out to a consultant if your personal monetary situations have actually recently become more complex. This might imply purchasing a home, marrying, having youngsters or obtaining a big inheritance.

Unknown Facts About Medicare Medicaid In Toccoa Ga

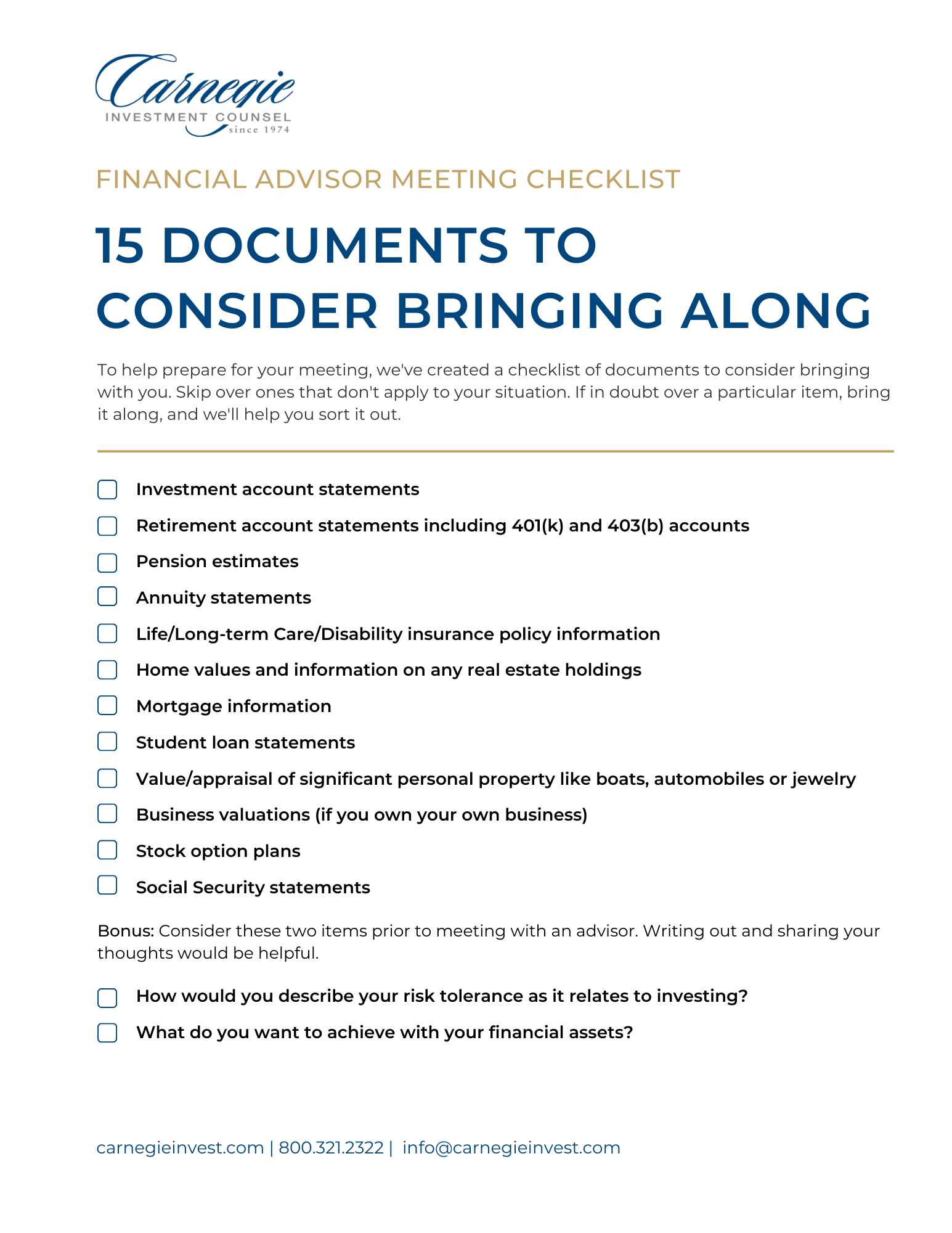

Prior to you fulfill with the advisor for a first appointment, consider what solutions are most vital to you. You'll desire to seek out an advisor who has experience with the solutions you desire.

What service were you in before you obtained right into financial advising? Will I be functioning with you directly or with an associate expert? You might likewise want to look at some example financial strategies from the consultant.

If all the samples you're given are the additional resources exact same or similar, it may be an indication that this advisor does not properly customize their guidance for every client. There are 3 major sorts of economic encouraging specialists: Qualified Economic Organizer specialists, Chartered Financial Analysts and Personal Financial Specialists - https://www.startus.cc/company/thomas-insurance-advisors. The Licensed Financial Organizer professional (CFP expert) qualification indicates that an advisor has satisfied an expert and honest standard established by the CFP Board

An Unbiased View of Automobile Insurance In Toccoa Ga

When choosing a monetary advisor, think about a person with a professional credential like a CFP or CFA - https://public.sitejot.com/jstinsurance.html. You might likewise take into consideration an advisor who has experience in the solutions that are most crucial to you

These experts are normally filled with disputes of rate of interest they're more salesmen than experts. That's why it's vital that you have an advisor who functions just in your finest interest. If you're searching for an advisor that can really provide actual worth to you, it is essential to research a variety of potential choices, not just pick the initial name that promotes to you.

Presently, lots of advisors have to act in your "finest interest," however what that requires can be almost void, other than in the most egregious situations. You'll require to locate a real fiduciary.

0, which was passed at the end of 2022. "They need to show it to you by revealing they have actually taken serious continuous training in retired life tax obligation and estate planning," he states. "In my over 40 years of method, I have actually seen expensive irreparable tax mistakes due to lack of knowledge of the tax guidelines, and it is unfortunately still a huge problem." "You must not spend with any consultant that doesn't invest in their education.